Table of Contents

An invoice is a written document containing details of transactions and payments made by the seller to the buyer. This invoice will be proof of a bill that the customer must pay.

Whether it’s a small or large business, and in any sector, invoices play a critical role. But in reality, even until now, invoice collection itself is still one of the biggest challenges for business owners.

The main issue of invoice collection

Complicated invoice processing flow

If the business still relies on manual methods (paper-based invoices), it takes quite a lot of time to process it. Invoices must be made one by one based on incoming orders, then scanned, inputted into the system, sent to the relevant division for approval, and other further processes. This process consumes a lot of resources and is prone to human error.

Late invoice collection

With the manual process above, if a problem occurs, such as lost data to changes in price or quantity during the ordering process, the approval process must be repeated from the beginning. This makes the invoice collection schedule postponed. Delayed payments can affect business cash flow.

Delayed payments can also reduce customer satisfaction and trust. If the payment is delayed, everything after will also be delayed. For example, if the delivery of goods is past the schedule, the customer might run out of stock before the goods arrive.

High possibility of fraud

Due to the difficulty to be double-checked, it is easier to cheat with manual invoice collection, especially when partial payment is made. Transaction details on invoice paper, such as price, are easy to manipulate. Suppose there is a discrepancy or missing payment. In that case, the root cause will be more difficult to find due to a lack of monitoring and evidence.

Potential disputes with customers

Manual or cash payment has a high risk of fraud and human error. Received payments can only be confirmed after the salesman brings the money to the office. The most common problem is when the customer feels that they have paid, but the company has not received it, or the nominal is different. These problems will be difficult to trace because there is no concrete evidence of payment details such as nominal and time of payment, making it difficult to track.

Some of the things above are the most common challenges when collecting invoices. However, is there a solution for this? Of course, there is! Overcome the situation with the following tips:

Fast and Fraud-Free Invoice Collection Tips

1. Create digital & automatic invoices

As mentioned above, manual invoice collection takes more effort and time.

You can work around this by using a system that has invoice management features.

The invoice processing flow can be streamlined with an integrated system such as a DMS. Orders and invoices can be accessed through one platform without having to move into multiple hands, making it more concise and efficient.

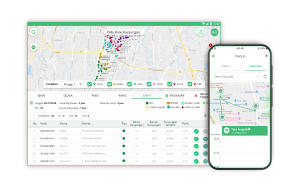

In Distri, every order request made by a salesman will go directly into the system. So that management can immediately provide approval, automatically generate an invoice, and process the orders immediately. In addition, every order is recorded automatically, and its progress can be tracked.

2. Provide flexible payment methods

Limited access to payments is one of the reasons why customers often delay payments. Especially if the transaction is with a large nominal, but the amount of cash held by the customer is not enough. Going to the bank will undoubtedly make them troublesome.

Suppose the payment method is more varied, such as using a virtual account or scanning a QR code. In that case, it will certainly make it easier for customers.

Distri, in collaboration with Stripe, provides payment options through virtual accounts that make it easy for customers.

As soon as the funds enter the company’s account, the system automatically changes the payment status. As a result, management does not need to do frequent reconciliations, reducing the risk of fraud.

Read more: Manage partial payment instalments from the store

3. Set a payment deadline reminder

So much work sometimes makes the seller and the customer forget the invoice payment schedule.

Creating a calendar as a reminder of payments might help you. A system equipped with a notification feature can also be a solution.

The Distri web portal is equipped with a notification feature to make it easier for management to manage invoices. For example, when invoices have been paid, a reminder of the unpaid invoice deadline and overdue invoices that exceed the payment due date.

Automatic notification systems like this can help you complete other tasks without missing the invoice collection time. As a result, smooth cash flow and business remain productive.

Maximize productivity and minimize risk with Distri, which integrates all business activities. Say no more to manual processes that take time, effort, and also cost, and are risky for human error.