Table of Contents

What comes to your mind when you hear the word invoices?

Bill? Debt?

The meaning above can be right or wrong. It depends on the purpose of creating the invoice itself. It is often used in daily activities, especially in business. It is one of the essential elements in the industry. That’s why you need to understand what invoices mean, their primary functions, examples, to the benefits for business, as Distri will review in full in this article.

What are Invoices?

It is a proof of a transaction between the seller and the buyer, which contains details, such as a description of the seller and the buyer, a list of goods/services purchased, the date of the transaction, and the total payment.

It is a written document (both paper and electronic) made by the seller, who will later be given to the buyer. Company usually makes them in several copies; the seller/company keeps one as an archive & attachment to financial reports, one for the buyer, and the other for tax reporting purposes.

Invoice is critical to track the company’s buying & selling activities, especially transactions with credit or installment payment methods.

The Main Functions

- Store purchase details

- As proof of billing to the buyer

- Track customer receivables (especially installment payments)

- As a reference, when there is a discrepancy in the payment or delivery process

- Simplify the bookkeeping process of financial statements

- As an attachment to business tax reporting

Its Benefits for Business

1. Transparency on Inflow and Outflow of Money & Goods

Invoices contain accurate details of sales/purchasing transactions. All transactions are recorded, and the nominal can be traced. These details will later facilitate the process of recording the company’s finances.

2. Track Payments

Invoices are written proof of how much payment must be billed to customers, company’s unpaid bills, or expenses that have been issued. Moreover, you can determine how much debt or receivables are left in transactions with the installment system.

3. Receivable Billing Tool

Would you pay for something without knowing what the money was spent on? This invoice will serve as a reference and valid document for the billing because it contains detailed information regarding orders, discounts, taxes charged, to the total that needs to be paid.

4. Original Evidence of Obligation Fulfillment

Besides proof of billing to consumers, invoices also prove that the company has carried out its obligations to collect or pay taxes. For example, customers will be charged VAT (Value Added Tax) for every purchase. The seller will later report the tax in the SPT, and this invoice will be the concrete evidence.

Invoices Types

Businesses commonly use several types, depending on the transaction type and what industry is being carried out.

1. Ordinary Invoice

This type is the most commonly used for simple transactions in daily activities. Usually, it only contains details, the number of items purchased, the price per item, and the total to be paid.

2. Consular Invoice

This invoice is used explicitly for import-export activities or international trade. Invoices are declared official after being ratified by trade attachés (representatives of importing countries), consular offices and embassies of importing countries located in exporting countries.

3. Proforma invoice

This invoice is explicitly made for transactions that send goods in stages. It is created every time a shipment occurs as a substitute for an ordinary invoice. For example, if the entire order has been shipped, it will be replaced with the ordinary one.

Components in Invoice

The invoice that the seller generates must have the following information:

- Transaction date

- Order number (according to the number from the company)

- Name of seller & buyer

- Product details

- Sub-total products

- Discount (if any)

- Shipping costs (if any)

- Sales and purchase tax (VAT)

- Total order payment

- Payment method

- Payment deadline (if paid in credit or installment)

- Signature and evident name of the selling company

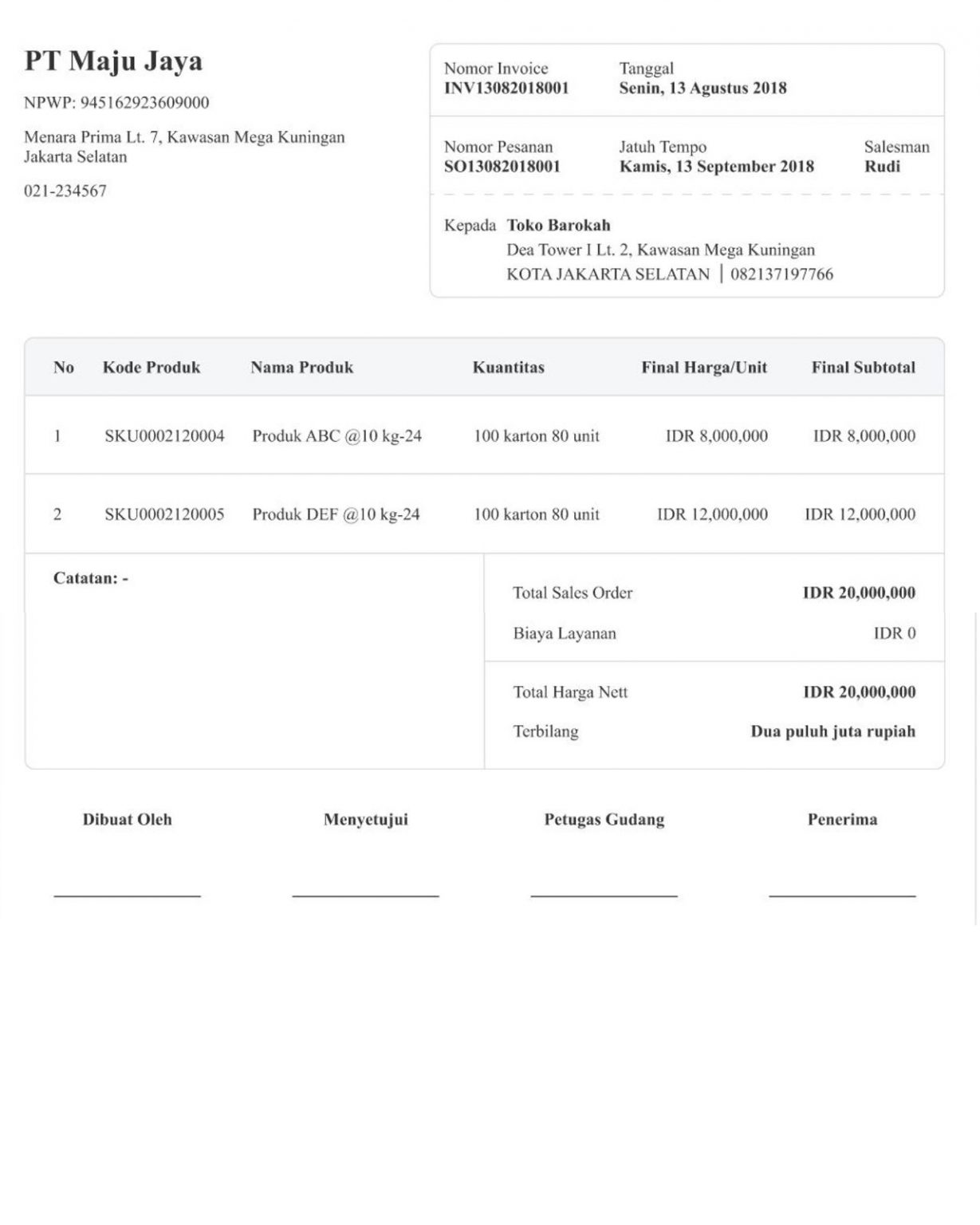

Each company usually has its own format. However, you can also use invoice templates on the internet as a reference. Here’s one example:

Some of the above can be used as a reference for making invoices. Understanding everything related to invoices allows you to create invoices that best suit your business needs.