Table of Contents

In business, recording cash in and out is essential. It indicates how business funds are circulated. Where and for what the money is used? However, manual recording is prone to human error, so bank reconciliation is needed to ensure the accuracy of the company’s financial records.

Bank reconciliation matches the company’s financial records with bank statements. This must be done to determine if there is a difference in the balance between the two documents. Various things can cause a difference, but the most common causes are unrecorded bank administration fees, interest distribution, and human error.

Bank Reconciliation Steps

- Record current account transactions into the company’s financial records.

- Compare and review balances in company accounts and financial records.

- Match the date of each transaction on the company’s bank statement and financial records.

- Make a bank reconciliation worksheet or journal, and calculate the difference.

- Find and re-check if there is still a balance difference.

When should Bank Reconciliation be Done?

The company usually do the reconciliation at the end of the month. In the past, the bank usually sent a bank statement that contained all transaction activities carried out by the company. But now, companies can download bank statements through internet banking. Then, it will be compared to the company’s financial records. The documents will be checked one by one based on evidence of transactions, such as proof of deposit or funds withdrawal.

However, for businesses with sales that use the transfer payment method, it would be better if the bank reconciliation is done daily. Especially in this sophisticated era, there are many loopholes for cheating, one of which is fictitious transfers. Therefore, daily reconciliation is required to verify that customers’ non-cash payments have entered the account to anticipate any fraud.

Reconcile Using Distri’s Accounting System

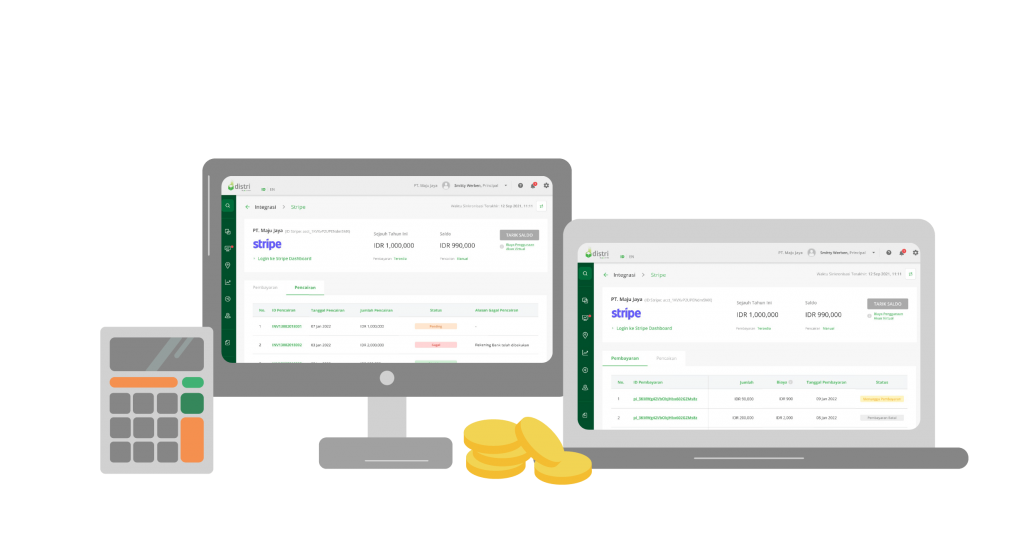

In collaboration with Stripe, Distri’s accounting system is in direct sync with sales transactions. When the customer makes a payment, the Distri system will immediately give a confirmation notice if the money has entered the account.

This feature will make it easier for you to match cash coming in and out of the bank and customer payments.

Want to know what else the District’s accounting system can do?