Table of Contents

You ask; Distri listens.

The right distribution system can dramatically affect the smooth running of the business. Suppose the daily business operations run effectively and efficiently, the overall business management can also run well. What does it mean? Companies can focus more on increasing sales.

Beside inventory management , there are some common customer complaints in managing a business, one of which is business accounting. Companies often use separate accounting systems because their current distribution systems do not have accounting features. However, even if it already exists, the offered features can still not answer business accounting needs, especially outside daily sales.

After hearing a lot about this need, in the last few months, Distri has been working hard to fulfill business wishes by continuously improving our services. So now, the Distribution System has been equipped with several additional supporting features.

We proudly present Distri’s latest features to answer your concerns

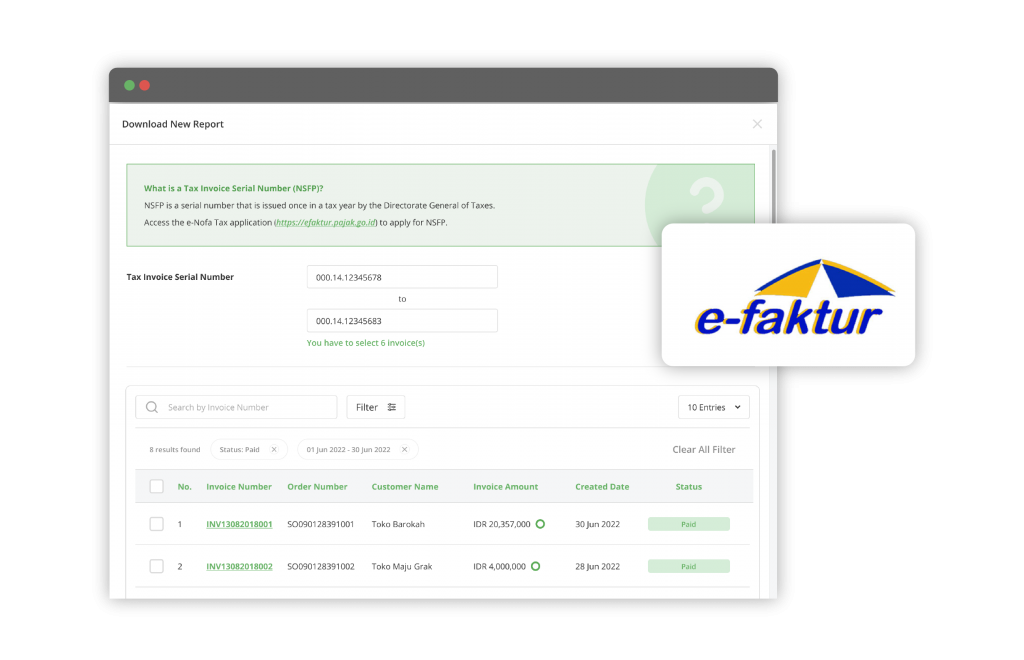

1. E-Faktur:

Taxable Enterprises ( Pengusaha Kena Pajak) are required to report an Annual SPT every year. They also have to attach invoices (electronic or manual) as proof that they have collected tax from every sales transaction of taxable goods or services that they do.

The Directorate General of Taxation (DGT) has made it mandatory for businesses to make e-Faktur nationally since July 1 2016. Suppose all sales transactions in a year, which may be in the tens, hundreds, or even thousands, must be regenerated according to the DGT reporting format. In that case, it will undoubtedly take a lot of time.

With the electronic invoices (e-Faktur) feature in the District distribution system, all sales recorded will automatically generate sales invoices, which can later be downloaded in CSV format (according to DGT requirements), ready to be uploaded directly to the DGT tax/e-invoice application.

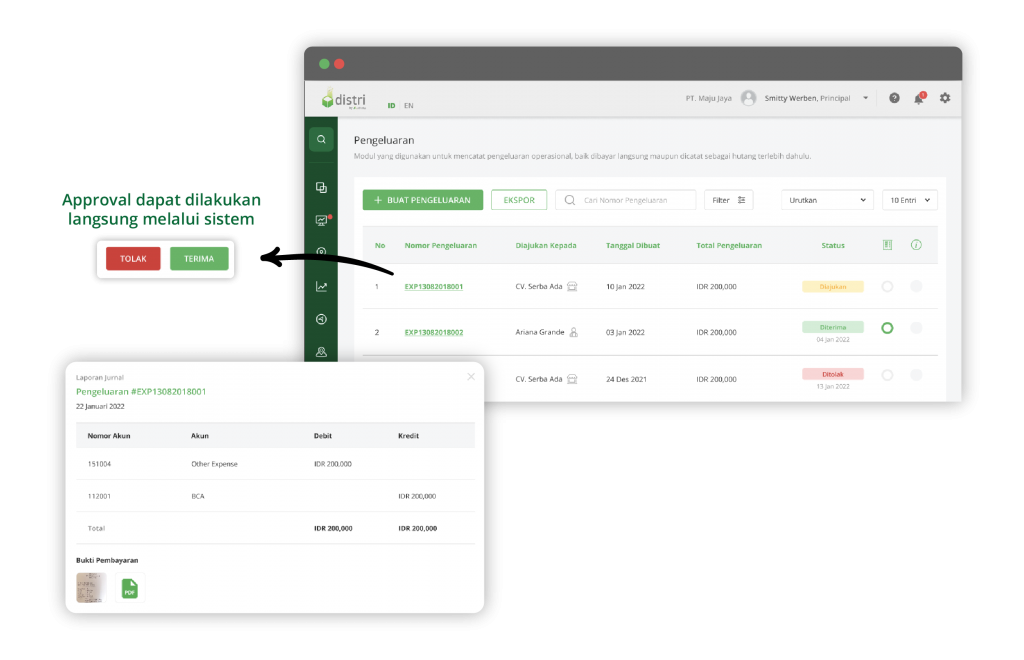

2. Expenses

Business income is generated from sales, while operating costs are generated from activities that support revenue generation. For example, office rental costs, advertising expenses, transportation, assets purchasing, and so on.

Expenses are used to calculate net income. Therefore, recording these expenses is very important to find out how much the sales profit is.

With the Expense feature on the Distribution system, vendor payments, employee reimbursement, and operational expenses borne by the company are recorded in detail and accurately, accompanied by proof of payment. In addition, supervisors can immediately approve or reject expenses that have been submitted. Approved expenses will also be automatically recorded in the accounting journal.

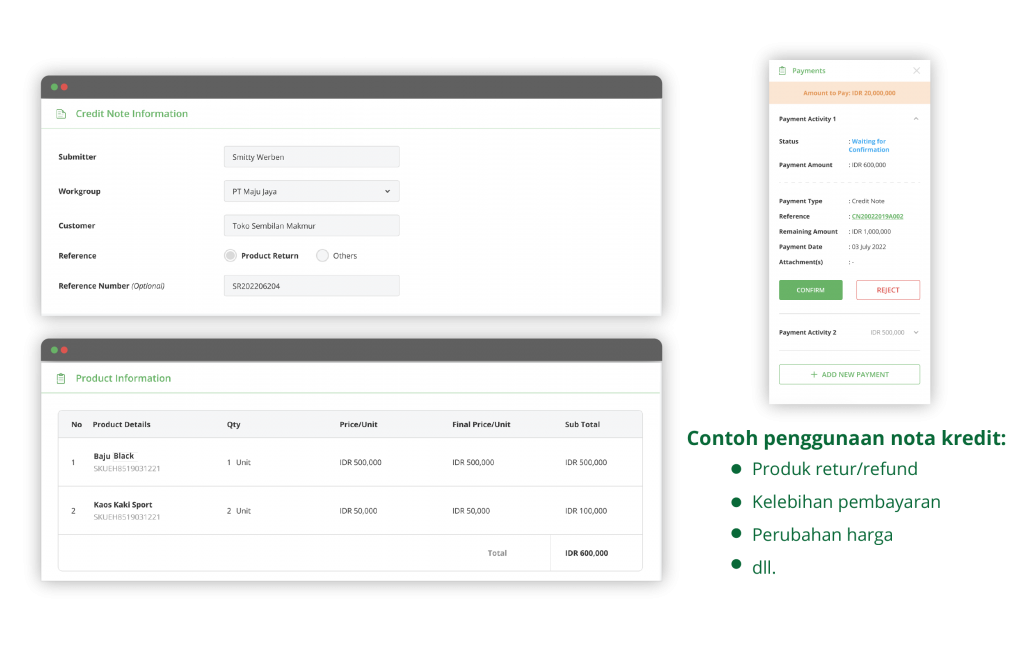

3. Credit Notes

Not all buying and selling transactions always run smoothly. Sold products can be returned for several reasons, such as damaged condition or different specifications compared to the description. However, product returns are common in the business world.

Sales returns can be made by exchanging the damaged product for a new product or returning it in the form of money in the amount according to the product. However, the actual value of the returned product can also be transferred to invoice payment so that the buyer’s payable to the seller is reduced.

With Distri credit note feature, you can create credit notes manually or automatically from product returns and deduct customer balances directly. For example, a buyer returns a product worth Rp. 200,000, while he still has an unpaid invoice for Rp. 1,000,000. Well, you can create a credit note worth Rp. 200,000 and allocate it to unpaid invoices. So the buyer needs to pay off the remaining debt of IDR 800,000.

Not only product returns, but you can also use this credit note when things happen, such as overpayments, price differences, minor errors in invoice amounts, and so on.

The company needs accounting and financial information to make business decisions. Not only is it required by internal companies, but business financial information is also needed by parties outside the company, such as potential investors, creditors, to the tax office. Therefore, businesses need to record everything related to the money’s ins and outs in the company as accurately and in as much detail as possible.

The main reason why Distri updates and launches various distribution management features is to make obtaining detailed business financial information more manageable. From the various excellent features that Distri already has, such as bookkeeping & financial reports, invoice management, sales & purchase orders, to product returns that are directly integrated into various distribution and business financial activities, innovations have emerged to support distribution management features that have been there before.

Much has changed since the first time you visited Distri. Explore the features now! You will love it!